Menu

The concept of consumer–brand identification (CBI) is central to our understanding of how, when, and why brands help consumers articulate their identities. This paper proposes and tests an integrative theoretical framework of the antecedents of CBI. Six drivers of CBI, a moderator, and two consequences are posited and tested with survey data from a large sample of German household consumers. The results confirm the influence of five of the six drivers, namely, brand–self similarity, brand distinctiveness, brand social benefits, brand warmth, and memorable brand experiences. Further, we find that all five of these antecedents have stronger causal relationships with CBI when consumers have higher involvement with the brand’s product category. Finally, CBI is tied to two important pro-company consequences, brand loyalty and brand advocacy. Theoretical and managerial significance of the findings are discussed.

“Choices are made more easily—either more routinely or more im- pulsively, seemingly—because one object is symbolically more harmonious with our goals, feelings, and self-definitions than another.”Sidney J. Levy (1959, p. 120)

“Why has the Toyota Prius enjoyed such success … when most other hybrid models struggle to find buyers? One answer may be that buyers of the Prius want everyone to know they are driving a hybrid .In fact, more than half the Prius buyers surveyed this spring … said the main reason they purchased their car was that ‘it makes a statement about me.’”Micheline Maynard (2007)

Striving for a sense of self (i.e., answering the question, “Who am I?”) is a fundamental aspect of the human condition (Belk, 1988; Berger & Heath, 2007; Brewer, 1991; Freud, 1922; Kleine, Kleine, & Kernan, 1993; Tajfel & Turner, 1985). Further, as succinctly put by Belk (1988, p. 160), “we are what we have”—what we buy, own, and consume define us to others as well as to ourselves. In this context, it is widely recognized that brands have the ability to embody, inform, and communicate desir- able consumer identities (Bhattacharya & Sen, 2003; Escalas, 2004; Escalas & Bettman, 2003, 2009; Fournier, 1998, 2009; Lam, Ahearne, Hu, & Schillewaert, 2010; Levy, 1959; Strizhakova, Coulter, & Price, 2008; Tsai, 2005). Not surprisingly then, a growing body of research has focused on what it means for consumers to identify with brands and the implica- tions of such consumer–brand identification (CBI) for both consumer be- havior and effective brand management (e.g., Chernev, Hamilton, & Gal, 2011; Escalas & Bettman, 2003, 2009; Lam et al., 2010).

Much less is understood, however, about the drivers of CBI—what factors cause it, when, and why. While a comprehensive sense for what produces CBI is of considerable importance to both marketing academics and practitioners, these issues have been examined from many diverse perspectives, causing our understanding to be rather fragmented. For instance, in their work on consumer–company iden- tification, Bhattacharya and Sen (2003) draw on social identity theory to proffer consumers’ self-defining and enhancing motives as the main drivers of identification (see also Ahearne, Bhattacharya, & Gruen, 2005; Bhattacharya, Rao, & Glynn, 1995). The work of Escalas and Bettman (2003, 2009), on the other hand, locates such identity-based bonds in the broader social context, suggesting that consumers bond with brands whose identities are consonant with desirable reference groups and celebrity endorsers. The communal consumption of brands and its role in the construction of identity narratives by consumers is stressed in the work of Fournier (2009), McAlexander, Schouten, and Koenig (2002), Muniz and O’Guinn (2001), and O’Guinn and Muniz (2009). Sociocultural factors such as the circulation of brand stories and myths among consumers are highlighted by Brown, Kozinets, and Sherry (2003), Diamond et al. (2009), Holt (2005), and Thompson, Rindfleisch, and Arsel (2006). Thomson, MacInnis, and Whan Park (2005) and Park, MacInnis, Priester, Eisingerich, and Iacobucci (2010), on the other hand, emphasize the role of emotional reactions to the brand in the formation of consumer–brand connections. It is also worth noting that while it is assumed that CBI can occur in a wide range of categories, empirical research in this domain has usually been restricted to single category studies (e.g., Lam et al., 2010), thereby precluding a deeper under- standing of the category-specific determinants, if any, of CBI.

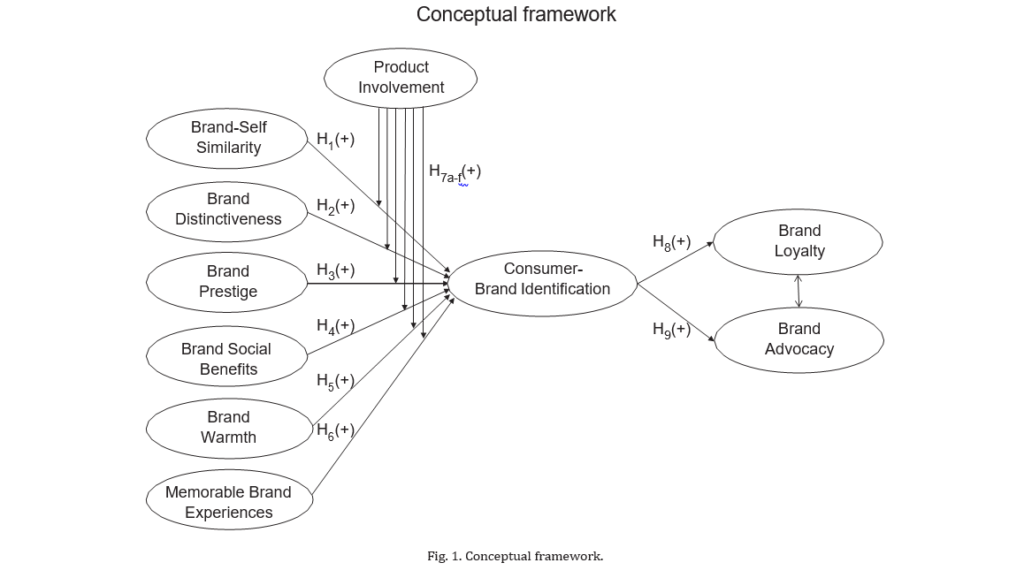

Given this backdrop of fragmented insights into the drivers of CBI, the present paper makes three key contributions. First, it synthesizes a wide range of ideas pertaining to identity construction, identification, and brand relationships to provide a comprehensive conceptual framework for the determinants of CBI. The outcome of our conceptual synthesis is a set of six antecedents of CBI that includes three primarily cognitive variables (brand–self similarity, brand distinctiveness, and brand prestige) as well as three affectively rich brand-related factors (brand social benefits, brand warmth, and memorable brand experiences). Second, to strengthen the validity of our conceptual framework and to go beyond extant single category examinations of CBI (e.g., Lam et al., 2010), we implicate an important category-level variable product category involvement as a moderator of the relationships between CBI and its various drivers. Ad- ditionally, we relate CBI to two key consequences: brand loyalty and brand advocacy. Finally, in the process of establishing this nomological network for CBI, we develop a valid, parsimonious measure of this focal construct that attempts to assess the state of CBI more indepen- dently of its antecedents and consequences (e.g., social rewards, nega- tive affective states produced by discontinued brand usage) than extant measures (e.g., Lam et al., 2010).

Next, we develop our conceptual framework culminating in a set of predictions pertaining to the antecedents and consequences of CBI. We then test our hypotheses with survey data from a large sample of Ger- man household consumers. The paper ends with a discussion of the the- oretical and managerial significance of our findings.

Brands, as carriers of symbolic meanings (Levy, 1959), can help con- sumers achieve their fundamental identity goals and projects (Belk, 1988; Escalas & Bettman, 2009; Fournier, 2009; Holt, 2005; Huffman, Ratneshwar, & Mick, 2000). Therefore, consumer–brand identification, defined here as a consumer’s perceived state of oneness with a brand, is a valid and potent expression of our quest for identity-fulfilling mean- ing in the marketplace of brands. This definition is consistent with the or- ganizational behavior literature, wherein identification typically has been defined as a perception of oneness with or belongingness to some human aggregate, such as employees with their companies or students with their alma maters (Ashforth & Mael, 1989; Bergami & Bagozzi, 2000; Bhattacharya et al., 1995; Mael & Ashforth, 1992; Stuart, 2002). Note that consistent with the theory in this domain (Bergami & Bagozzi, 2000; Bhattacharya & Sen, 2003), we assume that the state of CBI is distinct from the process of comparison of self traits with brand traits that may contribute to CBI.

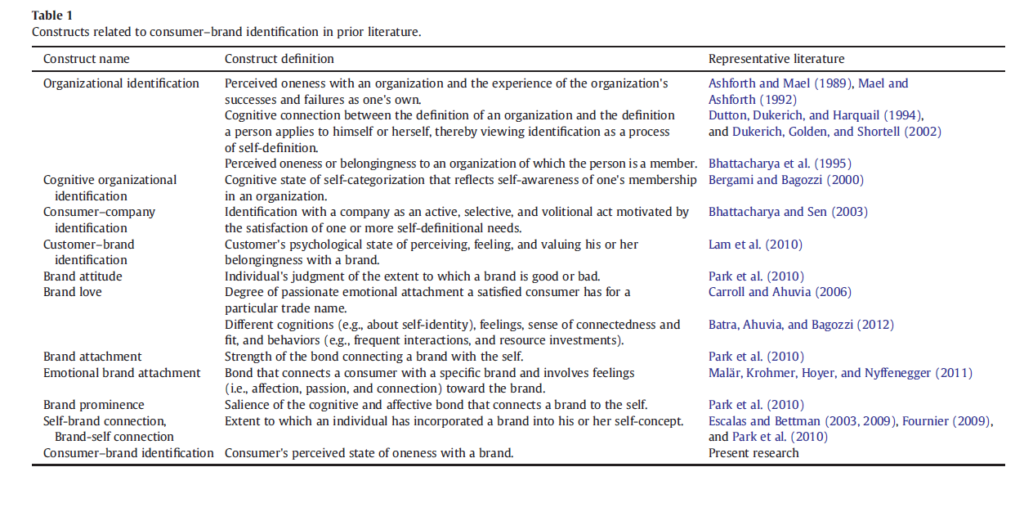

Table 1 presents an overview of constructs related to CBI and their definitions from prior literature. While our conceptualization of CBI is rooted in organizational identity, it is related to the construct of self-brand connections proposed by Escalas and Bettman (2003, 2009), defined as the extent to which an individual has incorporated a brand into his or her self-concept. However, the construct of CBI is, no- tably, narrower in that it excludes the potential motivations guiding such self-brand connections, such as communicating one’s identity to others and achieving one’s desired self (both part of Escalas and Bettman’s self-brand connection measure). CBI is similarly akin to the broader notions of brand-self connection in the work of Park et al. (2010) and the component called self-connection in Fournier’s (2009) Brand Relationship Quality (BRQ) scale. As in the case of self-brand con- nections, we regard the construct of CBI as narrower than, but potential- ly overlapping with, constructs such as BRQ (Fournier, 2009) and brand attachment (Park et al., 2010). Lam et al. (2010) take a somewhat different approach by defining CBI as “a customer’s psychological state of perceiving, feeling, and valu- ing his or her belongingness with a brand” (p. 130). In doing so, these authors view CBI as a formative construct composed of three dimen- sions. The cognitive dimension of their construct is similar to the notion of cognitive organizational identification in the work of Bergami and Bagozzi (2000). The emotional consequences of brand usage serve as the second dimension of Lam et al.’s CBI construct, and “evaluative CBI” is its final dimension, defined as “whether the consumer thinks the psychological oneness with the brand is valuable to him or her individually and socially” (p. 137). Unlike Lam et al. (2010), we do not regard brand partner value as part of the construct of identification. In- deed, as we argue later, the social benefits of a brand can actually influ- ence brand identification, thereby serving as an antecedent to the construct rather than being an integral part of it. We further depart from Lam et al.’s (2010) conceptualization in that, consistent with the theory of Park et al. (2010), we view CBI primarily as a cognitive repre- sentation, albeit one that can have an abundance of emotional associa- tions. Our view is consistent with that of Bergami and Bagozzi (2000), who argue that the emotional consequences of identification must be kept separate from the state of identification.

More generally, we regard CBI as different from the pure emotion- al bond that is embodied in the concepts of emotional brand attach- ment (Malär, Krohmer, Hoyer, & Nyffenegger, 2011) and brand love (Batra, Ahuvia, & Bagozzi, 2012; Carroll & Ahuvia, 2006). Batra et al. (2012), in particular, include not only the dimensions of positive emotional connection and self-brand integration in their construct of brand love, but also positive brand evaluations. In contrast, we re- gard positive brand evaluations (i.e., brand attitudes) as conceptually different from CBI because while the former references just the brand as a target of evaluation, CBI hinges on both the perceived brand iden- tity and the self-identity of the consumer. Accordingly, brand evalua- tions are likely to be either inputs or outputs of CBI rather than a part of CBI. Similarly, Allen and Meyer’s (1990) measure of affective com- mitment goes beyond the individual’s perceived psychological state to include certain consequences of that state (e.g., “I enjoy discussing my organization with people outside it”).

The need for identification is thought to be motivated by one or more higher-order self-definitional needs (Brewer, 1991; Kunda, 1999; Tajfel & Turner, 1985). Specifically, we need to (1) know our- selves, (2) feel relatively unique, and (3) feel good about ourselves. Thus, three key needs that are likely to drive identification in the con- sumption domain are that for self-continuity or self-verification, self-distinctiveness, and self-enhancement (Berger & Heath, 2007; Bhattacharya & Sen, 2003; Chernev et al., 2011). Based on these need drivers, we argue that identification with a brand is likely to be related to the extent to which a person perceives the brand (1) to have a per- sonality that is similar to his or her own (i.e., brand–self similarity), (2) to be unique or distinctive, and (3) and to be prestigious.

Note, however, that many theories of social identity and identifica- tion based on self-definitional needs (e.g., those in the social cognition and organizational behavior domains) mainly focus on the cognitive construction of the self. As such, they do not fully account for the nature of the ties that bind consumers to brands. Most fundamentally, brands are things that we consume, often over time and repeatedly, thereby im- plicating aspects of the consumption experience itself as integral to why we identify with some brands and not many others (Escalas, 2004; Escalas & Bettman, 2003; Fournier, 1998; Holt, 2005; McAlexander et al., 2002; Thompson et al., 2006; Thomson et al., 2005). Accordingly, we consider the phenomenology of consumers’ interactions with brands and proffer three additional antecedent factors as predictive of consumer–brand identification. These include the extent to which con- sumers (1) feel that their interactions with a brand help them connect with important social others, (2) perceive a brand in warm, emotional terms rather than cold, rational ones, and (3) have fond memories of brand consumption experiences (see Fig. 1). Notably, these three ante- cedents are, by virtue of their experiential nature, more affect-laden than the three previously described cognitively driven antecedents of identification.

Much research (e.g., Kunda, 1999) attests to self-continuity or self-verification as a key motive for why people desire to maintain a clear and functional sense of who they are. Moreover, this need for a sta- ble and consistent sense of self is increasingly met in today’s consumer culture through assessments of congruity or similarity between one’s sense of self and one’s sense of commercial entities, such as companies or brands (see Bhattacharya & Sen, 2003; Escalas & Bettman, 2003; Kleine et al., 1993). In the brand domain, several researchers have noted the important role of the perceived congruity between brand and self personalities in consumers’ affiliations with brands (Aaker, 1997; Grubb & Grathwohl, 1967; Levy, 1959; Sirgy, 1982). Based on this prior literature, we formally define brand–self similarity as the de- gree of overlap between a consumer’s perception of his or her own per- sonality traits and that of the brand, and we propose that this construct is a determinant of CBI.

H1. The more the brand–self similarity, the more the consumer will identify with that brand.

It has long been recognized that people strive to distinguish them- selves from others in social contexts (e.g., Tajfel & Turner, 1985); Snyder and Fromkin’s (1977) theory of uniqueness positions this need as a key component of people’s drive to feel good about themselves (i.e., self-esteem). This theme is developed further in Brewer’s (1991) theory of optimal distinctiveness, which suggests that people attempt to resolve the fundamental tension between their need to be similar to others and their need to be unique by identifying with groups that satisfy both needs. The expression of such needs for distinctiveness in the consumption realm is perhaps best reflected in the construct la- beled as consumer’s “need for uniqueness” (Tepper Tian, Bearden, & Hunter, 2001), defined as “an individual’s pursuit of differentness rela- tive to others that is achieved through the acquisition, utilization, and disposition of consumer goods for the purpose of developing and en- hancing one’s personal and social identity” (p. 50).

We therefore posit that the distinctiveness of a brand is a key pre-cursor to a consumer’s desire to identify with that brand (see also Berger & Heath, 2007). Further support for this argument comes from research that has documented that consumers often seek to affirm their identities via consumption of brands that are perceived as being the polar opposites of mass-production, mass-consumption brands (Thompson et al., 2006). All else being equal, brands with images or identities that set them apart from their competitors will be more likely to be identified with, provided, of course, that the basis of this distinc- tiveness is not perceived as entirely undesirable or negative. Formally, we define brand distinctiveness as the perceived uniqueness of a brand’s identity in relation to its competitors, and we implicate it as a driver of CBI.

H2. The more a consumer perceives a brand to be distinctive, the more the person will identify with that brand.

People like to see themselves in a positive light. Self-concept research (Kunda, 1999) indicates that people’s need for self-continuity goes hand-in-hand with their need for self-enhancement, which entails the maintenance and affirmation of positive self-views, which lead to increased levels of self-esteem. Thus, it is not surprising that this identity-related need is also met, in part, through people’s identification with prestigious social entities such as organizations (Bhattacharya & Sen, 2003; Dutton, Dukerich, & Harquail, 1994; Mael & Ashforth, 1992). This aspect is paralleled in the notion of the extended self in the domain of consumer behavior, which refers to the incorporation of products and services that reflect positively on the owner into the person’s sense of self (Belk, 1988; Kleine et al., 1993). More broadly, much consumer research attests to the driving role of self-enhancement in consumers’ affinities to- ward brands (Escalas & Bettman, 2003; Fournier, 1998; Rindfleisch, Burroughs, & Wong, 2009; Thomson et al., 2005). Drawing on this research, we hypothesize that brand prestige, defined as the status or es- teem associated with a brand, is a driver of CBI.

H3. The more a consumer perceives a brand to be prestigious, the more the person will identify with that brand.

Self-definition is, per se, a social endeavor that involves locating oneself in reference to one’s social environment (Berger & Heath, 2007; Brewer, 1991; Laverie, Kleine, & Kleine, 2002; Solomon, 1983; Tajfel & Turner, 1985). Further, several studies suggest that brands are major carriers of social and cultural meaning (Diamond et al., 2009; Holt, 2005; Thompson et al., 2006). Three broad streams of re- search point to the social benefits provided by certain brands.

First, research on reference groups, defined as social groups that are important to a consumer, suggests that people often consume brands used by their reference groups to gain or strengthen their membership in such groups (see Escalas & Bettman, 2003 for a review). Second, the growing literature on brand communities portrays the brand as an es- sential device for connecting people to one another (Muniz & O’Guinn, 2001; O’Guinn & Muniz, 2009; Stokburger-Sauer, 2010). A brand community can be conceptualized as a specialized, non- geographically bound community that is based on a structured set of so- cial relationships among the admirers of a brand (Muniz & O’Guinn, 2001). Membership in such communities can result not only in identifi- cation with the community, but also with the brand that is its raison d’etre (Bagozzi, Bergami, Marzocchi, & Morandin, 2012; Bagozzi & Dholakia, 2006; O’Guinn & Muniz, 2009). Finally, and most broadly, scholars who have investigated subcultures of consumption suggest that consumers sometimes coalesce into distinct subgroups of society on the basis of a shared commitment to a brand (Schouten & McAlexander, 1995; Thompson et al., 2006). As in the case of brand communities, such groups are identifiable. That is, they can have a hier- archical social structure, a set of shared beliefs and values, and a unique set of rituals and jargon. Based on these various lines of research, we argue that consumers are more likely to identify with brands that help them to connect with important others, groups, communities, or subcultures. Formally defined as the social interaction opportunities and gains afforded by a brand, we expect brand social benefits to be a driver of CBI.

H4. The more social benefits a consumer perceives in a brand, the more the person will identify with that brand.

Drawing on Hirschman and Holbrook’s (1982) notion of hedonic consumption, a large and growing body of research distinguishes be- tween hedonic and utilitarian benefits, where the former refer to in- tensely experiential or emotional benefits (e.g., fun, pleasure, and excitement) and the latter refer to instrumental or functional benefits (e.g., Dhar & Wertenbroch, 2000; Okada, 2005). Interestingly, re- search in the person’s perception area provides a similar dichotomy by theorizing that the content of people’s stereotypes can be orga- nized with two key perceptual dimensions, “warmth” and “compe- tence” (Fiske, Cuddy, Glick, & Xu, 2002). Thus, a social or ethnic category in which a person belongs may be seen by others in relative- ly warm or cold terms, independent of perceptions of effectiveness, capability, or competence.

We suggest that a similar warm versus cold distinction can be ap-plied to brands. Based on a brand’s product category (e.g., clothing vs. coat hangers), its salient or differentiating attributes (e.g., visually pleasing vs. boring esthetics in the brand’s product designs), and its positioning via marketing communications (e.g., Apple vs. Dell; Rathnayake, 2008), the brand’s personality can come across as rela- tively warm or cold (Aaker, 1997; Fournier, 1998; Keller, 2004). Fur- ther, as in the case of person perception (Fiske et al., 2002), we posit that the warm–cold distinction as applied to brands is relatively inde- pendent of perceptions of brand quality, reliability, and functionality.

We further propose that the extent to which a brand is perceived in warm, emotional terms rather than in cold, rational ways is a key determinant of CBI. Given that identity construction and maintenance are inherently affective processes, warm, lovable brands are likely to be viewed as more suitable candidates for such important life-projects than cold brands. This notion is underscored by research on brand love, the passionate attachments that some consumers form with brands, which is associated primarily with hedonic brands (Carroll & Ahuvia, 2006). Indeed, much research points to the integral role of emotions in the construction of consumption-based identities (see Laverie et al., 2002 for a recent review), thus suggesting that warm, emotional brands are stronger candidates for identification than their cold counterparts. More specifically, warm brands are more likely, ceteris paribus, to carry more abstract, higher-order, identity-related brand meanings that pertain, for instance, to the brand’s values and ethics, rather than to concrete, lower-order mean- ings that pertain to the brand’s concrete features. Accordingly, warm brands are likely to be stronger and more meaningful candidates for identification than cold brands, and consumers will have more in- tense feelings about warmer brands and the role of those brands in their lives than they will about colder brands (Fournier, 1998; Park et al., 2010).

H5. The more a consumer perceives a brand to have a warm (vs. cold) personality, the more the person will identify with that brand.

Brands vary in the extent to which they provide their consumers with memorable experiences. Some brands do not occupy a salient position in memory in spite of frequent usage (Park et al., 2010). Other brands, even when infrequently used, can leave an indelible, af- fectively charged mark on the consumer’s consciousness; thus, the consumer periodically relives the positive experience. Arnould and Price (1993) document the nature of such emotional as well as mem- orable brand experiences stemming from an extraordinary consump- tion activity (i.e., river-rafting), but suggest that such experiences may also be tied, under certain conditions, to more mundane con- sumption activities involving everyday brands.

The role of memorable brand experiences is further supported by consumer research on autobiographical memories and narrative pro- cessing (Escalas, 2004; Sujan, Bettman, & Baumgartner, 1993). This line of research suggests that the consumption of certain brands is as- sociated with greater self-referencing and the construction of brand-related stories or narratives. Such a self-referencing process, in turn, produces more affect-laden as well as easily retrievable mem- ories (Escalas, 2004). Over time, such memories can even become im- bued with strong feelings of nostalgia (Brown et al., 2003; Holbrook, 1993; Holt, 2005; Moore & Wilkie, 2005; Muehling & Sprott, 2004).

Drawing on these ideas, we propose that the final antecedent of CBI is a construct we term memorable brand experiences, defined as the extent to which consumers have positive, affectively charged memories of prior brand experiences. Such brands are more likely to play a defining role in a person’s sense of self due to increased co-mingling of brand-related thoughts with self-related thoughts (Davis, 1979; Moore & Wilkie, 2005). Additionally, such experiences are often likely to result from narrative rather than discursive pro- cessing, as the former has been found to build stronger connections between the consumer and the brand (Escalas, 2004).

H6. The more memorable brand experiences a consumer has, the more the person will identify with that brand.

Knowing who they are (i.e., self-definition) and feeling good about themselves are twin goals of utmost importance to most individuals. Thus, the efforts people make to meet these objectives are likely to be both considered and considerable. In particular, to the extent that these goals are met, in part, through consumers’ identification with certain brands, these brands must belong, almost by definition, to product categories that the consumer actually cares about (Malär et al., 2011; Reimann & Aron, 2009). It is only in such categories that

individuals are likely to find brands that can actually meet their self-definitional needs, that is, brands that are eligible and worthy of identification.

Product category involvement (PI) is generally understood as the per- ceived relevance of a product category to an individual consumer based on his or her inherent values, needs, and interests (Zaichkowsky, 1985). We expect PI to moderate the relationship between the various anteced- ents and CBI for at least two reasons. First, as the definition suggests, product categories are more enticing to people when they associate them with important higher-order goals, such as value satisfaction (Bloch & Richins, 1983). In turn, such categories are likely to be more closely associated with individuals’ self-concepts and viewed as self- defining, making these product categories stronger candidates for CBI (Reimann & Aron, 2009). Second, people are more motivated to system- atically process information pertaining to categories with which they are more involved (Chen & Chaiken, 1999). Thus, all else being equal, con- sumers’ knowledge structures regarding high (vs. low) involvement product categories are more likely to contain deeply processed and highly elaborated beliefs regarding brands’ abilities to meet self-definitional needs.

To the extent that judgments of a brand’s standing with regard to each of the six posited antecedent variables, and an assessment of the implications of these perceptions for identification, require cognitive resources and effort, these influences are more likely to materialize in product categories where the consumer is highly involved. That is, high (vs. low) PI should enhance not only a brand’s perceived abil- ity to meet a consumer’s self-definitional needs but also a person’s motivation to process relevant information in that regard.

H7. The higher a consumer’s involvement in the product category in which a brand belongs, the stronger the relationship between (a) brand–self similarity and CBI, (b) brand distinctiveness and CBI, (c) brand prestige and CBI, (d) brand social value and CBI, (e) brand warmth and CBI, and (f) memorable brand experiences and CBI.

The marketing literature provides ample support for the notion that identification is linked to a sustained, long-term preference for the identified-with company’s products (Bhattacharya & Sen, 2003). Homburg, Wieseke, and Hoyer (2009), for instance, report a strong influence of customer–company identification on customer loyalty. Additionally, Lam et al. (2010) show that CBI inhibits consumers from switching branehavior (i.e., total purchases in a set time frame). Thus, it can be argued that CBI is a predictor of loyal brand behavior, which we define as a deeply held intent to rebuy or re-patronize a preferred brand in the future (Oliver, 1999).

H8. The more a consumer identifies with a brand, the more loyal that person will be to that brand.

the recommendation of the company (and its offerings, or as an em- ployer) to others or the defense of the company when it is attacked by others. Physically, advocacy can involve buying and using company merchandise that displays the company logo or name, collecting mem- orabilia, apparel, or even acquiring tattoos (Katz, 1994). In organiza- tional research, Mael and Ashforth (1992), for instance, have found that there is a strong positive relationship between identification of alumni with their alma mater and both social (e.g., advising others to at- tend the school) and physical promotion (e.g., attending college func- tions). Accordingly, we suggest that CBI will produce brand advocacy, at least in the social sense of the brand’s promotion to social others. This is consistent with the research of Park et al. (2010), who report a strong influence of brand attachment on such promotion behavior. Ad- ditionally, Ahearne et al. (2005) show that customer–company identifi- cation affects customer extra-role behaviors, which was measured in part through company recommendation. All in all, then, we expect CBI to be positively related to brand advocacy.

H9. The more a consumer identifies with a brand, the more the person will advocate that brand.

Next, we describe three studies, two pilot studies and one main study that together provide tests of the nomological network for CBI as presented above.

Our goals in this study were to develop a better understanding of the phenomenon of CBI, generate items to measure CBI, and conduct a real- ity check on whether we were generally on the right path with the vari- ables we had identified as the drivers of CBI. One-on-one in-depth interviews that lasted between 30 and 80 min were conducted with eight (three females and five males) German consumers who ranged in age from 26 to 57. The interviews were conducted in German by the first author and a research assistant. A semi-structured approach was used in these interviews. The interviews commenced with a very broad question on the topic of identification, “Is there anything with which you identify?” Subsequently, more focused questions were asked, e.g., “With whom do you identify? Which companies? Which brands?” The interview questions then built on the participants’ initial responses by exploring the salient attributes and characteristics of par- ticular companies and brands named by the participant and the brands’ and companies’ links to the participant’s sense of self. Several of the follow-up questions also probed the thoughts and feelings that were prompted by the brands mentioned by the participants.

The data from these depth interviews furthered our phenomeno-logical understanding of the concept of CBI and the specific role of brands in identity construction. The comments of the participants re- garding what identification meant to them also enabled us to gener- ate 16 potential items for our measure of CBI. The participants’ comments and responses additionally provided us some initial vali- dation for the antecedent variables postulated in our framework. For example, many of the comments related to similarities between what a brand personified to a participant and the participant’s con- strual of his or her own personality. A second group of responses delved into unique or distinguishing characteristics of particular brands, including aspects such as brand quality and prestige, and then tied these specific aspects to self-image and the projection of identity. Another set of responses involved explicit references to friends, significant others, and other consumers who used the same brand. Finally, a sense of deep intimacy with a brand, emotional con- nections to a brand, and vivid brand consumption experiences were also frequently mentioned by the participants.

Our goal in this study was to develop a parsimonious, valid measure of CBI that captured the psychological state of identification and distin- guished it from its antecedents and consequences. We started with the 16 items from pilot study 1 and added to it 16 additional items that were adapted from prior literature on identification (e.g., Bergami & Bagozzi, 2000; Mael & Ashforth, 1992; Smidts, Pruyn, & van Riel, 2001). The study was conducted online with German consumers and using a very large mail order retailer as the target brand. We chose this retailer as the target brand for two reasons. First, due to the brand’s long history and tradition, not only is virtually every respondent likely to be aware of the target brand, but many are likely to have or to have had a relationship with this brand. Relatedly, because of its market pres- ence and full-range of products, this retailer has a very large customer base, making it more likely that our respondents are quite knowledge- able about the target brand. Indeed, we found that of the 382 partici- pants, as many as 148 participants (39%) were customers; the average age of the respondents was 36.7 years, and 43% were females. As in the main study, the participants were asked to rate their level of agree- ment or disagreement (using 7-point scales) with the statements pertaining to the various items.

Analytical methods such as an exploratory factor analysis (EFA), re-liability analyses (Cronbach’s alpha and item to total correlation, ITTC), and a confirmatory factor analysis (CFA) were employed. Statistical criteria for item retention involved an average factor loading above .70 and an average corrected ITTC above .50. The normal distribution as- sumption associated with the maximum likelihood (ML) method of es- timation in the CFA did not hold for the responses to the scale. The ML procedure, however, is known to be fairly robust against moderate vio- lations of normality (e.g., Browne, 1984; McDonald & Ho, 2002). The global fit criteria applied in the CFA were the Chi-square test (χ2), the Comparative Fit Index (CFI), Root Mean Squared Error of Approxima- tion (RMSEA), and the Tucker–Lewis Index (TLI). Additionally, we used the following local fit measures: indicator reliability (IR), factor loading (FL), t-value of factor loading (t-value), composite reliability (CR), and average variance explained (AVE). The MPLUS program was employed for the CFA (Muthén & Muthén, 2006). The results of a mul- titude of iterative analyses showed that 15 of the 32 items were the best candidates for assessing CBI. Of these, ten emerged from the first pilot study, while five were based on measures used in prior research.

Next, we describe our main study, the goals of which were two-fold: to (a) develop our final measure of CBI based on the 15 items obtained in this pilot study and (b) use this measure to test our predictions regarding the antecedents and consequences of CBI.

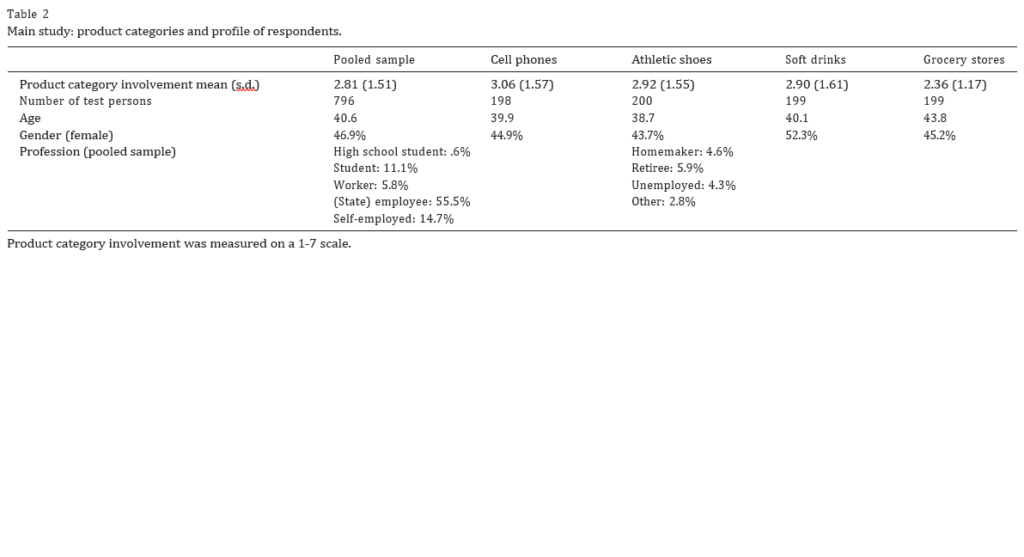

We tested the hypothesized model of CBI with data from a panel of German household consumers (796 participants). A few of the partici- pants either did not follow the instructions or provided incomplete re- sponses and thus were dropped from the data set (final N =781). The participants had an average age of 40.6 years, and nearly half (46.9%) were females. Table 2 provides a demographic profile of the survey par- ticipants broken down by product category.

The study involved four product categories, that is, athletic shoes, mobile phones, soft drinks, and grocery stores. While we selected prod- uct categories that vary considerably in the needs that they serve, all are widely consumed and are often consumed in public. Further, to ensure that the data would have sufficient variance with regard to key variables such as CBI and product category involvement, we avoided products where people may have responded uniformly at the upper end of the scales for those variables (e.g., automobiles). Note that the four product categories included one frequently purchased consumable (soft drinks), two shopping goods (athletic shoes and mobile phones), and one service-oriented category (grocery stores).

Data for this study were collected through an online survey of a Ger- man household panel maintained by a commercial market-research firm. Panel members were contacted via email and provided the URL of a password-protected website for participating anonymously in the online survey. A lottery-based monetary incentive system was used to motivate participation. Given the length of the instrument, each respon- dent was asked to take the survey with respect to only one product cat- egory, which the survey software randomly assigned to each respondent. In effect, the final sample sizes did not vary much across the target product categories, ranging from 198 to 212 in each case.

The participants were informed that they would be participating in a short consumer behavior survey. The survey first assessed whether a re- spondent was a user in the assigned product category. If the answer was in the negative, a different product category was randomly assigned. Next, depending on the assigned product category, the respondent was asked to name the brand that he or she (a) had last consumed (soft drinks), (b) had last visited (grocery stores), or (c) currently used most often (athletic shoes and mobile phones). After eliciting the target brand in this manner, the survey then presented the respondent with items designed to measure the variables in the theorized model. The sequence of the items was intentionally designed to be the reverse of the causal direction of the hypotheses to minimize possible demand effects. Specifically, the instrument first measured brand loyalty and brand advocacy. Next, the survey included items that assessed CBI (de- scribed in Section 4.1.4, below); then, the hypothesized antecedents and moderating variables were presented. Note that to better evoke the thoughts and feelings associated with the target brand, the survey software automatically inserted the respondent-specific brand name in each and every one of the brand-related scale items that were presented to the respondents. The survey closed with a few demo- graphic questions.

All items used in the survey involved 7-point agree–disagree Likert scales. These items were initially developed in English by the research team and then translated into German and finally translated back into English to verify vocabulary, idiomatic, grammatical, and syntactical equivalence (Steenkamp, ter Hofstede, & Wedel, 1999). The questionnaire was pre-tested with a small sample of respondents (N = 12), and based on their feedback, some minor changes were made in the wording of the items. For developing the items used in our measures, we drew on existing scales wherever possible and adapted them as necessary to fit the context of our research. The de- tails are discussed in subsequent sections and the full scale items are presented along with reliability and validity statistics in Appendix A.

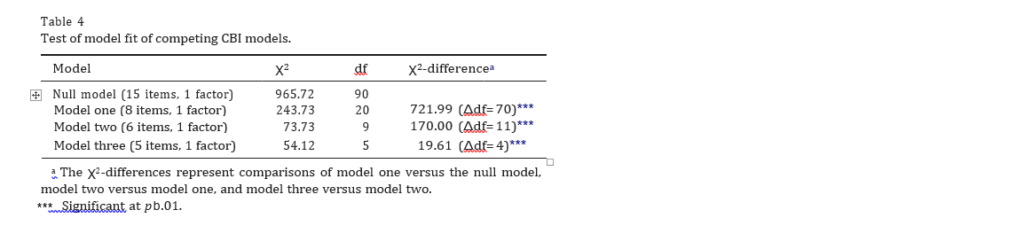

As previously discussed, prior literature and our two pilot studies yielded a battery of 15 potential items to assess CBI. The results of a multitude of iterative analyses (including alpha, ITTC, EFA, and CFA) revealed that of these 15 items, five items best represented the state of CBI (see Table 3). This scale is highly reliable with an alpha of .94 and ITTCs ranging from .82 to .89. Furthermore, the EFA explained 82% of variance, and second-generation fit indices were also satisfac- tory. The study, for instance, produced the following goodness-of- fit-measures: χ2 (5) = 54.12, RMSEA=.10, SRMR=.03, CFI=.99, and TLI=.98.

We tested the robustness of the scale in four additional ways. First, we assessed the model fit separately for each of the four product cat- egories and found it to be satisfactory in every case. Second, using a bootstrapping procedure (Fitzgerald Bone, Sharma, & Shimp, 1989), we serially drew 100 bootstrap samples (with replacement) of the total sample with a 50% fraction of the base sample and then tested the measurement model on the basis of the covariance matrices pro- duced by these samples. The results showed that the scale was stable with respect to all fit indices. Third, in an effort to further evaluate the candidate scale, three alternative factor structures (with 15, 8, and 6 items, respectively) were estimated. These scales were compared to the five-item scale using χ2-tests in CFA. To ensure that no important content was lost in developing a parsimonious scale, a measure containing all 15 items was used as a null model. The five-item scale strongly outperformed the null model (Δχ2 (85) = 911.6, p b.01) and the six-item scale (Δχ2 (4) = 19.61, p b.01). Additionally, the five-item scale slightly outperformed the six-item scale with re- spect to global fit (CFI=.990 vs. .989; TLI=.985 vs. .979; SRMR= .029 vs. .031). Overall, the five-item scale was found to be the best-fitting CBI measure (see Table 4).

Finally, to examine the robustness of the CBI scale, we conducted a validation study in another country with respondents who varied considerably in their demographics compared to the main study re- spondents. This study involved a survey of a sample of U.S. college students from a large mid-western university (415 participants; final N = 414) and included two of the four product categories in the main study, namely, athletic shoes (N = 212) and soft drinks (N = 203). The study was conducted using a computerized survey and administered in a university laboratory setting. Students signed up for participation to earn extra class credit. The average age of the student participants was 20.6 years, and 53.9% of the participants were females. Again, with this sample, the scale was found to be high- ly reliable, with an alpha of .93 and ITTCs ranging from .78 to .84. The EFA explained 78.3% of variance, and the CFA global and local fit indi- ces were also found to be satisfactory.

A test of discriminant validity of all study constructs including CBI is described in Section 4.2.2. However, we also assessed discriminant validity for the CBI measure with regard to another related construct, namely, brand commitment. As evident in the definition of Allen and Meyer (1996, p. 253), who view affective commitment as “identifica- tion with, involvement in, and emotional attachment to the organiza- tion,” identification and commitment are closely related constructs. Notwithstanding, in our conceptualization, we do not view identifica- tion as part of commitment or, conversely, commitment as part of identification. Instead, we assume that brand commitment is a psy- chological consequence of CBI. Evidence of discriminant validity for our CBI measure vis a vis brand commitment thus helps to establish the credentials of the former.

To operationalize brand commitment, we adapted items from the

commitment scales of Coulter, Price, and Feick (2003) and Beatty, Kahle, and Homer (1988). The resulting 3-item scale showed accept- able reliability and fit measures in our data with an alpha value of .68 and 62.3% of variance extracted by the EFA. The Fornell and Larcker (1981) test was used to analyze discriminant validity for CBI versus commitment. Pairwise correlations between factors obtained from a two-factor model were compared with the variance extracted esti- mates (AVE) for the two constructs. Discriminant validity exists when both variance extracted estimates exceed the square of the cor- relation between the factors. The AVE for CBI was .78, and the AVE for commitment was .43; in contrast, the squared correlation between CBI and commitment was .42. Thus, even though there is a positive relationship between the two constructs, there is also evidence of dis- criminant validity between them.

The measure for brand–self similarity was derived from separate assessments of the brand’s personality and the respondent’s own per- sonality using identical scales (Sirgy & Danes, 1982). These scales drew on Aaker’s (1997) work on brand personality, which shows that brand personality can be conceptualized as having five different dimensions, which, in turn, can be represented with a total of 15 “facets” (Aaker, 1997, pp. 351–352). Therefore, we assessed both brand personality and the respondent’s own personality with 15 items (7-point, agree–disagree scales), with one item for each of the facets proposed by Aaker (1997). The brand–self similarity measure was then constructed as follows. First, the Euclidean distance D be- tween the two personality assessments was computed. Next, this dis- tance measure was rescaled to a similarity measure S with a theoretical range of 1 (minimum) to 7 (maximum) by applying an ap- propriate linear transformation (S =7−.2582D).

The three items used to measure brand distinctiveness were taken from existing scales (e.g., Bhattacharya & Sen, 2003). Brand prestige was also measured with three items drawn from prior liter- ature (e.g., Bhattacharya & Sen, 2003; Mael & Ashforth, 1992). The four items used for brand social benefits were based on the literature on brand communities (e.g., McAlexander et al., 2002). Brand warmth was operationalized with three items adapted from Moore, Ratneshwar, and Moore (2012). Memorable brand experiences were measured with three items adapted from Gladden and Funk (2001). Product category involvement was assessed with four items drawn from prior research (e.g., Mittal & Lee, 1988). Brand loyalty was measured with three items taken from the literature (Chaudhuri & Holbrook, 2001; Coulter et al., 2003), and finally, brand advocacy was assessed with three items (e.g., Brown, Barry, Dacin, & Gunst, 2005).

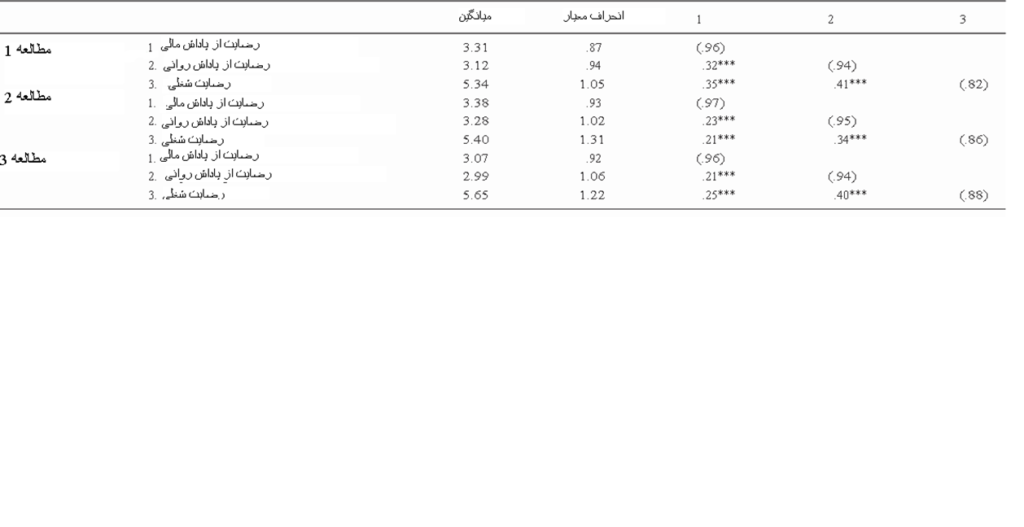

All measures were found to be highly reliable and valid. The psy- chometric properties of the scales were assessed through Cronbach’s α, CR, ITTC, EFA, and CFA. Descriptive statistics and the correlations between the various measures are shown in Table 5 with the data pooled across the four product categories. Before pooling the data, tests of measurement invariance were conducted using MPLUS, and Chi-square difference tests in the CFA (Steenkamp & Baumgartner, 1998) confirmed that the measures were equivalent across the four product categories.

We assessed discriminant validity using the Fornell and Larcker (1981) test. Table 5 shows the correlations between all constructs. As the squared correlations are less than the AVE for every construct, there is evidence of discriminant validity.

Because we measured all constructs using respondents’ self- reports, it is important to rule out common method variance as a source of bias in the results (Podsakoff, MacKenzie, Jeong-Yeon, & Podsakoff, 2003). Accordingly, we conducted the following tests.

First, we included a common method factor (CMF) into the struc- tural equation model (SEM). Similar to Homburg, Mueller, and Klarmann (2011), who included a common method factor in the SEM to test H1 only, the CMF in our SEM was constructed to load on a selection of items used to measure the antecedents and CBI. Inclu- sion of such a factor helps to control for common method bias in our tests of hypotheses. We specified the loadings of the CMF to be of the same size to reflect the notion that common method variance influences all items equally and to achieve model convergence (e.g., Homburg et al., 2011; Rindfleisch, Malter, Ganesan, & Moorman, 2008). This procedure of including a method factor did not affect the findings regarding our hypotheses (see Section 4.2.4), which indi- cates that common method variance did not bias the results.

Second, we relied on the findings of simulation studies which have shown that the risk of common method variance is strongly reduced in models involving non-linear relationships (e.g., Evans, 1985; Siemsen, Roth, & Oliveira, 2010). Multiple group analyses of our data (see Section 4.2.5) confirmed that the relationships between

the antecedent variables and CBI differ in a predictable manner in dif- ferent subgroups of the sample. In addition to the multiple group analysis, we tested the nonlinearity in our model for selected vari- ables using latent interaction terms (e.g., Homburg, Klarmann, & Schmitt, 2010). The analyses, for instance, showed that a latent inter- action model produces significant (p b.01) and stable results for the interactions of product category involvement (PI) with brand–self similarity and brand distinctiveness.

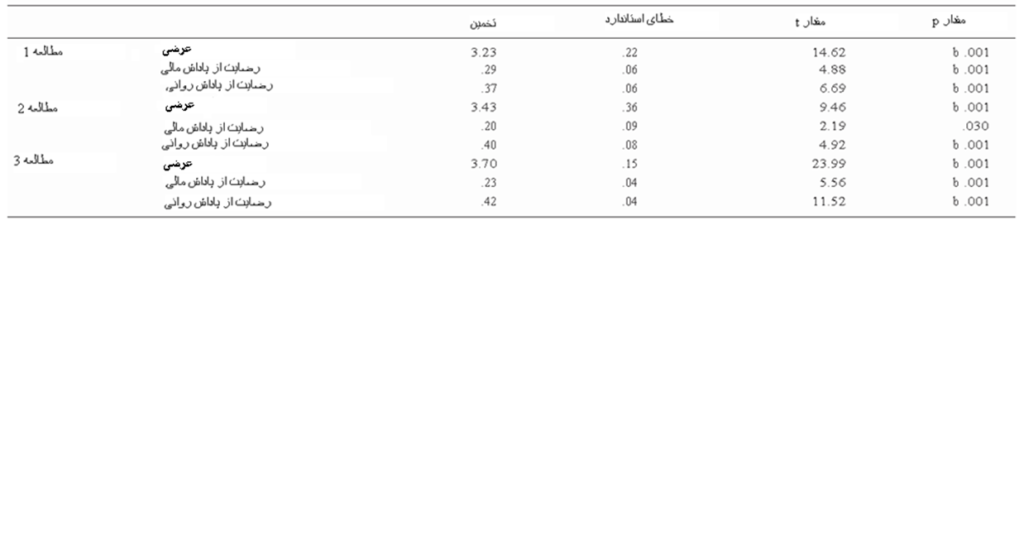

H1 to H6 and H8 to H9 were tested with structural equation modeling using MPLUS (Muthén & Muthén, 2006). In addition to the hypothe- sized antecedents of brand–self similarity, brand distinctiveness, brand prestige, brand social benefits, brand warmth, and memorable brand experiences, we added three dummy variables as independent variables to account for product category main effects on CBI. This set of predictor variables explained over half of the variance in CBI (squared multiple correlation, SMC=.59). Similarly, we achieved a good SMC for brand advocacy (.47) and a satisfying SMC for brand loyalty (.16). The fit statistics indicate a good fit for our model: χ2 (389) =2.21, RMSEA=.08, SRMR=.07, CFI=.91, TLI=.90.

The standardized parameter estimates for the main effects model are shown in the second column of Table 6. The results supported the predictions for brand–self similarity (H1, γ=.05, p b.10), brand distinctiveness (H2, γ=.08, p b.05), brand social benefits (H4, γ= .34, p b.01), brand warmth (H5, γ=.30, p b.01), and memorable brand experiences (H6, γ=.15, p b.01). Regarding brand prestige (H3), our study did not yield a statistically significant result. With re- spect to the downstream relationships between CBI and brand loyalty (H8), and between CBI and brand advocacy (H9), the model showed strong and significant results (β=.55 and .68, respectively, both p b.01).

The main effects model was further validated with the U.S. sample previously mentioned. The results were generally replicated in that sample, except that the relationship between brand distinctiveness and CBI was statistically non-significant, whereas the path from brand prestige to CBI was marginally significant (p b.10).

To test the moderated relationships implied by H7a to H7f for prod- uct category involvement (PI), we employed multiple group structur- al equation modeling. We first performed a median split for PI in each of the four product categories to create two subgroups, one with low

PI and one with high PI. Next, we tested the model for CBI (excluding loyalty and advocacy) simultaneously in both subgroups using MPLUS. The model fit was satisfactory as χ2 (498) = 1.43, RMSEA= .07, SRMR=.05, CFI=.93, TLI=.92.

The standardized parameter estimates for the two subgroups are shown in columns three and four of Table 6. The relationship between brand prestige and CBI was statistically non-significant in both sub- groups. The coefficients for the paths between brand–self similarity and CBI and between brand distinctiveness and CBI were statistically significant only in the high PI subgroup. The coefficients for the paths between the other three antecedents and CBI were statistically signif- icant in both PI groups. However, in accord with our prediction, in all three cases, the coefficient values were larger in the high PI subgroup when compared to the low PI subgroup.

As a follow up to the above pattern of results, a χ2-difference test was used to assess the statistical significance of the difference in the path coefficients between the subgroups. Here, an unconstrained model was compared with a constrained model wherein the two path coefficients were set to be equal. The results confirmed that the higher the PI, the stronger the relationship between brand–self similarity and CBI (H7a: Δχ2 (1) = 10.73, p b.01), brand distinctive- ness and CBI (H7b: Δχ2 (1) = 17.53, p b.01), brand social benefits and CBI (H7d: Δχ2 (1) = 15.24, p b.01), brand warmth and CBI (H7e: Δχ2 (1) = 18.69, p b.01), and memorable brand experiences and CBI (H7f: Δχ2 (1) = 13.69, p b.01).3

Given that our hypothesis tests entail causal modeling of survey data, the question naturally arises as to whether an alternative model may fit the data equally well. One way to examine this issue is to test an alternative model where the roles of the antecedent vari- ables and the focal dependent variable (CBI) are reversed. Our ap- proach follows the path of Morgan and Hunt (1994) and Hennig-Thurau, Gwinner, and Gremler (2002).

Specifically, we earlier offered theoretical arguments as to why brand–self similarity, brand distinctiveness, brand prestige, brand social benefits, brand warmth, and memorable brand experiences should influence CBI, which, in turn, should influence brand loyalty and brand advocacy. It is far more difficult to argue that CBI could play a similar causal role in driving the hypothesized antecedent variables. Accordingly, if our theory has merit, the causal model we employed earlier for H1 to H6 and H8 to H9 should fare much better empirically compared to an alternative model wherein CBI is treated as an independent (i.e., exogenous) variable and brand–self similarity, brand distinctiveness, brand prestige, brand social benefits, brand warmth, and memorable brand experiences become mediating variables in the relationship between CBI and the two downstream variables of brand loyalty and brand advocacy.

Following this logic, we tested the aforementioned alternative model with SEM. The model included the dummy variables for product category and the nine variables mentioned above. Note that the alternative model has ten more paths than the hypothesized model (i.e., 18 vs. 8 hypothesized paths, thus more paths by a factor of 2.25). We first compared the overall fit of the two models. The results showed that the global fit of the alternative model was much worse than that of the hypothesized model: CFIAlternative Model =.86 vs. CFI =.91; SRMRAlternative Model =.11 vs. SRMR =.07; and χ2 (413)Alternative Model =3195 vs. χ2 (389) = 2206. Next, as the two models are not nested in one another, it is appropriate to rely on Akaike’s Information Criterion (AIC; Akaike, 1987) for model comparison (Rust, Lee, & Valente, 1995). Smaller values of AIC indicate a better model fit. Again, the alternative model fared worse with respect to this fit statistic, AICAlternative Model=48,645 vs. AIC=47,694. Finally, it is worth comparing the proportions of the two models’ hypothesized parameters that turned out to be statistically significant. Again, the alter- native model performed worse than our hypothesized model. As noted earlier, as many as seven out of eight hypothesized paths (88%) in the hypothesized model were found to be statistically significant. In contrast, in the alternative model, only 12 out of 18 paths between the variables (67%) were statistically significant. The paths that were not supported by the data in the alternative model were those from brand–self similarity, brand warmth, and memorable brand experiences to brand loyalty and the paths from brand–self similarity, brand distinctiveness, and memorable brand experiences to brand advocacy. Therefore, all of the comparisons confirm that the hypothesized model is indeed superior to the alternative model.

The idea that brands can play a crucial role in the construction and maintenance of consumers’ identities is not new (Keller, 1993; Levy, 1959). Nonetheless, it is only recently that the concept of consumer– brand identification is finally receiving the conceptual and empirical at- tention it deserves (Escalas & Bettman, 2003, 2009; Fournier, 2009; Lam et al., 2010). This research adds to the growing body of knowledge on this topic by proposing and testing an integrated framework for the drivers, moderators, and consequences of consumer–brand identifica- tion. Based on a synthesis of a variety of literatures, the framework includes six antecedent factors for CBI, of which three are mainly cogni- tive in nature (brand–self similarity, brand distinctiveness, and brand prestige), while the other three are more affect-based (brand social benefits, brand warmth, and memorable brand experiences). We also theorize that the drivers will display stronger relationships with CBI when a consumer’s involvement with a brand’s product category is rela- tively high.

The results of the two pilot studies and a main survey study provided convincing empirical support for our framework. The six ante- cedents together accounted for over half of the variance in CBI in the main study, emphasizing their collective efficacy as determinants of our focal construct. Interestingly, very little support was obtained for the predictive role of brand prestige. Aside from the most obvious possibility that brand prestige does not, in general, influence CBI, it is plausible, given that there was sufficient variance on the brand pres- tige measure, that CBI is less sensitive to brand prestige in categories such as supermarkets, soft drinks, and even athletic shoes than in the more conventionally status or luxury product categories. Clearly, fur- ther research is needed to better understand the precise role of brand prestige. The results also provided reliable and consistent support for the hypothesized moderating role of product category involvement. Additional analyses revealed no evidence of a common method bias or the plausibility of alternative nomological networks (e.g., with re- versed causality). In providing these insights, this paper makes several contributions, both theoretical and managerial, which are discussed next.

This paper advances our understanding of the relationship be- tween brands and consumer identity in several key ways. First, this research provides an integrative understanding of the antecedents of CBI, bringing together drivers that have, thus far, been examined only in isolation. In particular, this paper is the first to propose and test an overarching framework for CBI that contains both cognitive and experiential (i.e., affect-rich) drivers of identification. Second, by providing evidence for the role of multiple drivers of CBI in a single model, we demonstrate that each of these drivers has an influence even when controlling for the effects of the others. Third, in contrast to the prominence bestowed on the cognitive drivers of identification in the company domain (e.g., Bhattacharya & Sen, 2003), our findings high- light a generally stronger role of the affective drivers (see, e.g., Table 6). It may be the case that a consumer’s idiosyncratic experiences with the ob- ject of identification matter more than reflective, mindful factors when the object is concrete and palpable, such as a brand, than when it is more abstract and amorphous, such as a company. Given that we did not contrast, in our studies, consumer identification with a brand versus a company, future research that does so would help to more definitively establish whether and to what extent the drivers of the two differ.

Further, this research is the first, to the best of our knowledge, to empirically examine the category-specific moderators of the relation- ship between CBI and a number of diverse drivers. By documenting the moderating effect of product category involvement, the present research provides a more nuanced, contingent theoretical picture of the forces underlying CBI (see also Escalas & Bettman, 2009; Reimann & Aron, 2009). Future research may be able to expand our nomological network even further, providing a fuller explication of the various contingencies that regulate the influence of the key drivers of CBI. Such research may also clarify whether the same drivers and moderating variables are at work in determining the in- tensity and durability of consumer–brand relationships (Fournier, 2009; Park et al., 2010). For instance, while we conceptualized brand–self similarity as the perceived congruence between consumers’ sense of their current or actual self and that of the brand, it is possible that under certain contingencies, such as low category involvement, low self-esteem, or high self-consciousness (Malär et al., 2011), it is the consumers’ sense of who they ideally would be (i.e., the ideal self) that may be more relevant in driving CBI.

Our research corroborates the positive link between CBI and its pro-brand consequences, such as loyalty and advocacy. Thus, it would seem that marketers would want to maximize CBI. At the same time, however, some recent research points to the potential limits and drawbacks of encouraging CBI (Chernev et al., 2011), suggesting that doing so may, in fact, make the consumer–brand rela- tionship more rather than less susceptible, at least in the short-run, to competing forces that satiate consumers’ need for identity- expression. While marketers would be wise to take this eventuality into account when planning their brand strategies, it is contingent on future research that establishes the long-term, rather than the short-term, effect of identity saturation on brand preferences.

That said, this research provides brand managers with some actionable insights into the why of CBI within their specific contexts. Managers of all product categories, regardless of consumer involvement levels, must focus on and better understand the more idiosyncratic and affect-rich experiences their consumers have with their brands to harness these in the service of greater CBI. Additionally, managers who offer products and services to highly involved consumers should pay special attention to consumers’ perceptions of a brand’s personality and distinctiveness. Our research also suggests that to enhance CBI, managers must ensure that their brands have high social value and thus serve consumers’ interpersonal goals (see also Muniz & O’Guinn, 2001; O’Guinn & Muniz, 2009; Schouten & McAlexander, 1995). This can occur not only through the fostering of interactions between the brand and the consumer through a myriad of approaches, from event marketing to product co-creation, but also through interactions among consumers around a brand, through brand communities, both physical and virtual. Additionally, marketers can enhance or at least highlight the emotional appeal of their brand, albeit within the constraints imposed by the brand’s functionality and overall positioning, with the objective of convincing consumers to think of the brand in a warm and emotional way, rather than as a cold and distant entity (see also Aaker, 1997; Diamond et al., 2009; Fournier, 1998; Park et al., 2010). This can be achieved not only through conventional communication strategies but also through a coherent, well thought-out CSR (i.e., corporate social responsibility) platform that, implemented correctly and genuinely, may contribute greatly to a brand’s perceived warmth.

Our findings also suggest that marketers can increase CBI by creating distinctive and memorable out-of-the-ordinary brand experiences (e.g., cruise ship gala banquets, Napa Valley winery wine tastings, and extraordinary personal touches at Kimpton Hotels). Clearly, this is easier said than done; affectively-charged memories reside ultimately in the consumer’s mind and are, thus, not under complete control of the marketer. At a minimum, then, marketers can attempt to provide the types of unique and vivid experiences that engender indelible memories, and they can then assess the extent to which these experiences and memories enhance CBI.

While this paper represents a significant advance in our understanding of the antecedents of CBI, it is not without limitations. The most important of these limitations is the fact that to test our framework, we had to infer causal relationships from cross-sectional survey data. Given the lengthy gestation period that is likely involved in a consumer identifying with a brand, experimental and longitudinal study designs seem unrealistic. Nonetheless, future research may be able to test at least parts of our framework with alternative methodologies.

Additionally, our results reveal a great deal of consonance be- tween the European respondents of our main survey and the U.S. respondents of the validating survey in terms of the key relationships in our model. However, an important question remains: Might the nomological network for CBI be different, particularly in radically different cultures, for instance, in parts of Asia, Africa, and the Middle-East? Future tests of the generalizability of the relationships to a broader cultural context are needed. In particular, given the rising economic, political, and cultural influences of the BRIC nations, it is important to validate our model with populations from these countries. Similarly, while our framework was tested with research participants spanning a wide range of demographics, there is room for greater generalizability through tests among demographic groups that we did not examine. More specifically, some secondary analyses suggest that the relationships between CBI and its antecedents are directionally stronger for the men in our sample than for the women. A deeper investigation of such gender differences may be of both conceptual and practical value.

Further, our study categories were restricted largely to products rather than to services, with supermarkets perhaps being the only exception. One could argue that this restriction results in a particularly stringent test of our theory, as the posited relationships, particularly between CBI and its experience-based determinants, are likely to be stronger for services than for products. At the same time, we obtained no meaningful differences across the four categories we examined in terms of the predicted relationships. Regardless, it is essential that our model be examined in a wider set of categories and settings, including services that have experiences as their core offerings. Such re- search and others of its type may be able to provide many more valuable insights on the fascinating topic of why consumers identify with some brands and not with others.

Maadico is an international consulting company in Cologne, Germany. This company provides services in different areas for firms so they will be able to interact with each other. But specifically, raising the level of knowledge and technology in various companies and assisting their presence in European markets is an aim for which Maadico has developed … (Read more)