Menu

Over the last decade, the demand for domestic and international flights in Korea has increased sub- stantially. To meet the strong flight demands, several low cost carriers have begun to offer flight services. In addition, full service carriers have been motivated to establish their own subsidiary low cost carriers to maintain their market share against rival low cost carriers. This paper studies the management strategies of three kinds of airlines – full service carrier, its subsidiary low cost carrier and rival low cost carrier – based on game theory in the competitive air transport market. Each airline is assumed to act as a player and chooses strategies regarding airfare, flight frequency, and the number of operating aircrafts for specific routes while maximizing its own profits. Demand leakages between the airlines are considered in the flight demand function according to the selected strategies of all airlines. Through various game situations reflecting realistic features, this study provides managerial insights that can be applied in the competitive air transport market.

After the declaration of the 1978 Airline Deregulation Act in the United States, the market situation of the air transport industry changed significantly. With the adoption of free competition, air- lines tried to improve their customer services. They began flight services in new routes and developed various airfare policies to ensure their survival. Various new airlines, including low cost car- riers (LCCs), entered the air transport market to satisfy diverse air transport demands. The concept of LCCs is to offer the flight ser- vices with the attractive prices that are much lower than the con- ventional full service carriers’ (FSCs) and even comparable to those of a car or train. By increasing the number of passengers, LCCs can get sufficient profits even though the unit profit per passenger tends to be less than that of FSCs. In addition, LCCs have tried to reduce all kinds of cost-related elements to secure their operating profits. Therefore, even though they cannot provide sophisticated services as compared with FSCs, the demand for LCCs has increased steadily by passengers who want only a basic transportation function.

The fare class structure of LCCs is relatively simple because they only operate one class: Economy and LCCs generally offer two kinds of airfares: Discount fare and regular fare. In addition, they usually provide flight services in point-to-point routes for simple and easy management. LCCs tend to choose lower-tariff airports (Marcus and Anderson, 2008). To get rid of commission payments, LCCs do not use travel agents and adopt the electronic ticketless systems or e- ticket utilizing websites. In addition, they keep a high flight fre- quency to maximize their utilization and adopt team competitive wages and profit sharing to maintain high productivity and effi- ciency (Evangelho et al., 2005). Generally, LCCs’ airfares are 30e40% lower than FSCs’, and LCCs’ operating costs are 40e50% compared to FSCs’ (Doganis, 2001). Through the emergence of LCCs, various alternatives are given to customers when they are choosing their airline, in terms of preference, airfare, flight frequency, etc. Thus, with the remarkable growth of the customer demand for LCCs, it is difficult for FSCs to ignore the LCC market and focus on the premium market.

In response to the steady growth of LCCs and to keep the market share at certain air transport market, some FSCs have developed certain tactics. Some have: (1) Established their own LCC as an internal unit or subsidiary against rival LCCs. (2) Tried to optimize their present operations by cutting off wasteful expenses while maintaining their current business model. (3) Transformed their business model to similar one of LCCs by reducing their current service levels (Morrell, 2005). Among the alternatives described above, this study has examined the first one, i.e., the FSC strategy of opening a subsidiary LCC against the rival LCC through a three player game situation.

Nowadays, there are five successfully operating LCCs in the Korean air transport market. Among them, Eastar Jet, T’way airline, and Jeju Air were established as pure LCCs, whereas Jin Air and Air Busan were launched as subsidiary LCCs of Korean Air and Asiana Airline, respectively. Both Korean Air and Asiana Airline are regarded as FSCs in the Korean air transport market. At first, LCCs only operated within the domestic air transport market, because several domestic routes such as Gimpo-Jeju and Gimhae-Jeju are highly profitable, regardless of season or day. After they secured the sufficient air transport demands of these domestic routes, they tried to advance the international air transport market by introducing large-size aircrafts such as the Airbus 330 and Boeing 777.

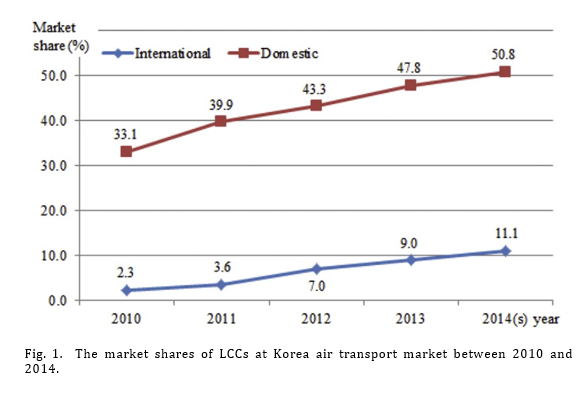

Fig. 1 depicts the LCC market share between 2010 and 2014, while the values of the 2014 year are forecasted. At present, the market share of LCCs is expected to be more than half of the entire domestic air transport market. In addition, the market share of LCCs in the international air transport market tends to increase contin- uously. Thus, the FSCs choose response strategies to deal with the increasing market share of rival LCCs, such as competing directly by launching subsidiary LCCs.

This study dealt with the airline’s optimal response strategies in the competitive air transport market by assuming operation situations both under a single route and multiple routes. Ac- cording to the business purpose and the competing environment, four kinds of game theoretic situations are defined. For each, this study tries to find optimal values for the airfares, the operating flight frequencies and the number of operating aircrafts of all airlines to maximize their profits. In addition, the demands of all airlines are regarded as a function of both the airfares and their operating flight frequencies.

In this study, it is dealt with the competitive market situation of the air transport industry with a FSC, a subsidiary LCC and a rival LCC, all of whom serve both single and multiple flight routes. It is examined four kinds of game theoretic situations with the case of collusion/competition and the case of a Stackelberg game. The demand of each airline is assumed a function of its airfare and flight frequency. The concept of demand leakage is also integrated into the demand function coming from the differences of airfares and flight frequencies among the three airlines. The mathematical model is developed with the objective of maximizing profits, while the decision variables are airfare, flight frequency, and the number of aircrafts in the fleet. To examine each airline’s behaviors under the four game theoretic situations, example problems are solved with the hypothetical system parameter values under a finite so- lution domain. In the single flight route case, a FSC can make more profits when a FSC is colluding with its subsidiary LCC and posi- tioned as the Stackelberg leader. This comes from the flexibility of strategic decisions. In addition, in Game 4, it can be checked the possibility that if a subsidiary LCC pursues to catch passengers who want to get more careful service but do not wish to pay the amount of a FSC’s airfare level, a subsidiary LCC can be positioned in the market as a medium-cost airline. In the multiple flight route case, a FSC can make more profits when colluding with a subsidiary LCC and being positioned as the Stackelberg leader. When a FSC is competing with its subsidiary LCC, two LCCs concentrate on the medium haul because of its higher marginal profits. However, when a subsidiary LCC is colluding with a FSC, a subsidiary LCC takes the short haul demand to maximize the profits of both a FSC and a subsidiary LCC. As a result, a subsidiary LCC can concentrate on the short haul journeys and a FSC will serve the more profitable medium haul when both colluding and playing a Stackelberg game.

For future studies, it is desirable to refine the objective function of the model to not only maximize profits, but also maximize market share or eliminate competing airlines. A multi-objective function could be implemented. In addition, if I can get real data from airlines or airports, it is needed to validate proposed game theoretic model with real data to derive more useful insights for practitioners.

Maadico is an international consulting company in Cologne, Germany. This company provides services in different areas for firms so they will be able to interact with each other. But specifically, raising the level of knowledge and technology in various companies and assisting their presence in European markets is an aim for which Maadico has developed … (Read more)