Menu

Unite and Collaborate for a Brighter Future!

Many renowned global companies have achieved financial stability and sustainable growth through mergers and collaborations while maintaining independent revenue streams via their marketing and sales divisions. In this complex journey, Maadico’s merger and acquisition consulting serves as a reliable guide. Maadico’s expert consultants, with a deep understanding of the challenges and opportunities ahead, assist companies in selecting the right partners, conducting financial evaluations, navigating contract negotiations, and ensuring the precise execution of mergers. As an international consulting firm in the field of mergers and acquisitions, Maadico offers specialized and professional services, helping businesses leverage the strategic benefits of mergers.

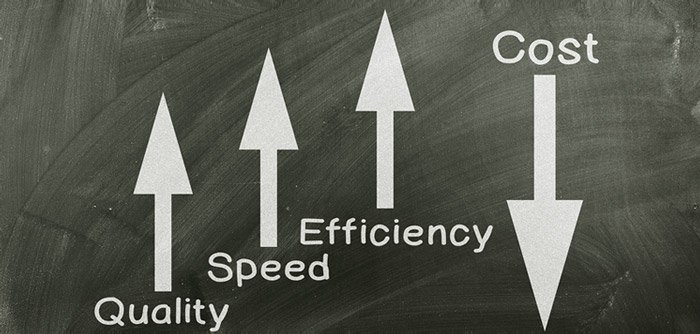

Mergers not only expand market reach and increase market share but also enhance company efficiency and reduce costs. By thoroughly analyzing opportunities and challenges at each stage, Maadico helps companies adopt the best strategies for successful mergers.

Beyond the financial and legal aspects, Maadico places special emphasis on managing organizational culture and aligning structures. With a deep understanding of economic trends and global markets, Maadico serves as a strategic partner, guiding companies to make smart decisions and capitalize on existing opportunities. Maadico’s consulting services in mergers and acquisitions provide companies with greater confidence as they navigate complex business processes, paving the way for their success.

Merger

A merger occurs when two or more companies decide to unite and form a single entity. Mergers can be horizontal (between companies in the same industry) or vertical (between companies in the supply chain). In a horizontal merger, two similar companies combine to increase market share and reduce competition. On the other hand, a vertical merger is aimed at controlling the supply chain and reducing costs.

Acquisition

An acquisition takes place when one company purchases another and gains full control over it. In this case, the acquiring company buys a significant portion of the target company’s shares, and it may or may not change the name or organizational structure of the acquired company. This process usually involves thorough financial, legal, and operational evaluations.

There are various types of mergers and acquisitions, each distinguished by its unique characteristics and goals. By understanding these types, companies can choose the right strategy for their merger and take advantage of M&A consulting to manage the process effectively and achieve desirable results.

Horizontal Merger: A horizontal merger occurs when two companies operating in the same industry decide to combine. This type of merger is aimed at increasing market share for a specific product. For example, the merger of two automobile manufacturers is an example of a horizontal merger.

Vertical Merger: In a vertical merger, two companies that operate at different stages of the supply chain combine. This type of merger can lead to increased efficiency and reduced costs in the supply chain.

Concentric (Related) Merger: In this case, two companies whose activities or products complement each other merge. For instance, a merger between a bank and a leasing company is an example of a related merger.

Conglomerate (Unrelated) Merger: In this type of merger, two companies from different and unrelated industries combine. This merger is usually aimed at diversification and expanding into new areas of business. For example, the merger of a home appliances company and a petrochemical company is an example of an unrelated merger.

Choosing the Right Partner: Companies must carefully select their partner, as this choice can significantly impact the success or failure of the merger.

Thorough and Accurate Assessment of Financial and Operational Conditions: It is essential to ensure that both companies are financially healthy and stable, and that the merger will be beneficial for both parties.

Seeking Expert Consultation: A business merger consultant, with their experience and expertise, can help companies gather sufficient information about the merger process and make the right decisions.

Maadico is an international consulting company in Cologne, Germany. This company provides services in different areas for firms so they will be able to interact with each other. But specifically, raising the level of knowledge and technology in various companies and assisting their presence in European markets is an aim for which Maadico has developed … (Read more)