Menu

Business-model research has struggled to develop a clear footprint in the strategic management field. This introduction to the special issue on the wider implications of business- model research argues that part of this struggle relates to the application of five different perspectives on the term “business model,” which creates ambiguity about the conceptual boundaries of business models, the applied terminology, and the potential contributions of business-model research to strategic management literature. By explicitly distinguishing among these five perspectives and by aligning them into one overarching, comprehensive framework, this paper offers a foundation for consolidating business-model research. Furthermore, we explore the connections between business-model research and prominent theories in strategic management. We conclude that business-model research is not necessarily a “theory on its own” and that it can be more fruitfully understood as a theoretical mechanism for combining different literature streams. As such, business-model research is positioned as a central connecting component in the further development of the strategic management field.

In recent years, a strong academic interest in business models has emerged. Business models are descriptions of how a firm or, more generally, a person or an organization does business (Chesbrough and Rosenbloom, 2002; Magretta, 2002). A business model describes how a given actor “chooses to connect with factor and product markets” (Zott and Amit, 2008, p. 3). In other words, it is a construct “that mediates between technology development and economic value creation” (Chesbrough and Rosenbloom, 2002, p. 532). Thus, a business model explains how an actor is positioned within a value network or supply chain, and how a business turns inputs into outputs while fulfilling its goals.

Contributions to this stream of literature have focused on the theoretical roots of business models (Amit and Zott, 2001); the general role and idea of business models, especially in relation to value creation (Casadesus-Masanell and Ricart, 2010; Chesbrough and Rosenbloom, 2002); the components and elements of business models (e.g., Osterwalder and Pigneur, 2010; Johnson et al., 2008); the interconnections among business-model elements (Zott and Amit, 2010; Ritter, 2014); the logic of businesses (Casadesus-Masanell and Tarzija´n, 2012); the nature and implementation of user-centric business models (Hienerth et al., 2011); and the emergence of new organizational forms and their implications for business-model innovation (Fjeldstadt, Snow, Miles and Lettl, 2012; Foss and Saebi, 2015; Snow et al., 2011), as well as numerous other topics. As documented in a steadily increasing number of publications (DaSilva and Trkman, 2014), this rich stream of literature has created a detailed but fragmented understanding of business models (for a review, see Massa et al., 2017; Zott et al., 2011). As several researchers note, “there continues to be little agreement on an operating definition” (Casadesus-Masanell and Ricart, 2011, p. 102) and “the academic literature on this topic is fragmented and confounded by inconsistent definitions and construct boundaries” (George and Bock, 2011, p. 83). Similarly, all contribution to this special issue highlight the lack of a common definition and understanding of business models. As such, the business-model concept remains ambiguous and clarity is needed in order to move the field forward.

While such conceptual ambiguity hinders theoretical development and demands academic attention, the aim of this special issue is to elaborate on the connections between business-model research and established theories in the strategic management literature. In other words, this special issue investigates the ways in which business-model research contributes to the development of theories and the extent to which this stream of research is influenced by theories. This special issue offers a range of insights into these questions and points out relevant research agendas.

This introduction is organized as follows. First, we outline the five perspectives found in business-model research in order to provide a foundation for a discussion of wider implications. Second, we offer an overview of relevant “adjacent” theories, which also serves to position the contributions of this special issue. Third, we suggest a new positioning and understanding of business-model research in the strategic management literature and outline open research questions.

When reviewing the extant business-model literature, we identified five different perspectives on the term “business model”: business-model activities, business-model logics, business-model archetypes, business-model elements, and business-model alignment. Each of the five perspectives has a distinct way of defining business models and all of them are meaningful in their own right. In line with Baden-Fuller and Morgan’s (2010) suggestion to interpret business models in multifaceted ways, we suggest that the five perspectives can co-exist, as they supplement each other. However, they need to be explicitly applied and distinguished from each other in order to avoid ambiguity and confusion.

One perspective views a business model as a description of the activities that the firm has put together in order to execute its strategy (Arend, 2013). Zott and Amit (2010, p. 216) frame business models from “an activity system perspective,” stating “we conceptualize a firm’s business model as a system of interdependent activities that transcends the focal firm and spans its boundaries.” In a similar vein, Chesbrough (2007, p. 12) defines a business model as “a series of activities, from procuring raw materials to satisfying the final consumer.” This thought is mirrored in Massa and Tucci’s (2013, p. 9) view of business models as a “systemic and holistic understanding of how an organization orchestrates its system of activities for value creation.” This perspective is closely related to business processes and business-process reengineering (DaSilva and Trkman, 2014) as well as Porter’s idea of the firm as a value chain of different activities (Porter, 1985).

Instead of looking at value-chain activities, another stream of business-model research describes the flow of logical arguments that summarizes the logic of the business: “doing more of x raises the returns of doing of y and vice versa” (Brynjolfsson and Milgrom, 2013). In other words, this stream focuses on why certain activities make sense for a business in terms of the value-creating logics that those activities introduce. Along these lines, Shafer et al. (2005, p. 202) state that business models are “a representation of a firm’s underlying core logic.”

Casadesus-Masanell and Ricart (2011) define a business model as a set of relationships and logical loops of consequences that can (and should) create virtuous cycles rather than vicious cycles. They also argue that firms may operate two (or more) logics that supplement each other. For example, LAN Airlines has both a low-cost logic for its regional routes and a quality business logic for its long-distance routes (Casadesus-Masarell and Ricart, 2011).

Archetypes describe generic logics of how firms do business, i.e. business-model archetypes are general, well-known business model logics. Business-model archetypes are typical models of value creation and value capture that transcend industry boundaries (Baden-Fuller and Morgan, 2010). A classic example is the “razor and blade” business model in which a firm sells a product at a reasonable price and earns above-average profits by selling consumables that customers need to use that product. This business model is widespread e examples include Nespresso’s sales of coffee machines, which require special coffee capsules; Hewlett-Packard and Canon’s sales of toner cartages for their printers; and medical equipment firms’ sales of test liquids for use with their equipment.

An alternative archetype that attracts a great deal of attention is the two-sided-platform business model. The idea of this business model is to earn money by bringing two groups of users together e typically one group with a need and another group with possible solutions. Examples of this type of business model include Uber (bringing people with a transportation need together with people with a car) and AirBnB (connecting apartment owners with travelers).

“Power by the hour” (turning products into services), “low cost” (undercutting current price levels with “no-thrill” offerings), or “freemium” (offering a basic level for free and selling higher-level offerings at a premium price) are other commonly discussed business-model archetypes. Baden-Fuller and his colleagues are developing a “business-model zoo” (www.businessmodelzoo.com) to provide an overview of the different archetypes.

A different perspective on business models is taken by authors who propose structuring business models on the basis of essential elements in order to capture the important parts of a business. In this regard, we find a variety of suggestions. Johnson et al. (2008) propose a structure based on customer value proposition, profit formula, key resources, and key processes. Osterwalder and Pigneur (2010) suggest a selection of nine elements: key partners, key activities, key resources, value proposition, customer relationships, channels, customer segments, cost structure, and revenue streams. Teece (2010) views value proposition, market segments, value appropriation, and value-chain organization as key elements of business models (see also Chesbrough, 2007). In other words, “a good business model answers Peter Drucker’s age-old questions: Who is the customer? And what does the customer value? … How do we make money in this business? What is the underlying economic logic that explains how we can deliver value to customers at an appropriate cost?” (Magretta, 2002, p. 4).

The underlying idea of the business-model elements perspective is that every firm can and should describe its business in terms of what it does (similar to the business-model activities stream but broken down into capabilities and resources, and including the activities of the eco-system; e.g., Osterwalder and Pigneur, 2010), what it offers (value proposition), how the offer is made (customer interaction in relationships and channels), and who the customers are. These frameworks ensure that all necessary elements are described in order to capture the essence of a business. However, this business-modeling method does not describe the logic e rather, the business-model’s logic is implicit in the design of the elements.

Early in the business-model discussion, Magretta (2002, p. 6) stated that a business model describes “how the pieces of a business fit together.” In this perspective, which builds on Wernerfelt’s (1984) resource-product matrix and Ansoff’s (1957) product-market matrix, the success and failure of organizations are determined not only by the elements of the business model but also by their complementarity, interrelationships, and alignment (Ritter, 2014). This focus on the interplay among business-model elements brings business models closer to the general notion of strategy (DaSilva and Trkman, 2014) because a firm’s strategy describes “how all the elements of what a company does fit together” (Porter, 2001, p. 71). However, although one might assume that the close proximity of strategy and business models could be a problem for theory development, that proximity is actually a necessity for academic relevant business models can only be useful for strategic management if they are able to capture (or illustrate) the core of strategy (the alignment of the different parts). In this special issue, Foss and Saebi argue that only the alignment perspective offers a significant contribution to the academic discourse, as the other interpretations are already covered by other theories.

As illustrated in Fig. 1, the five perspectives on business-model research are complementary. Together, they offer a comprehensive framework for understanding organizations and the strategic options available to them. While the unreflected use of the different perspectives creates challenges for theoretical development and managerial practice, their explicit combination creates a solid foundation for further advancement of the field.

The basic foundations of an organization are its activities, its resource transactions, and its transformations. Therefore, activities (or processes and capabilities) serve as the basis for understanding what a business does e they are the micro- foundations, or building blocks, of business models and, thus, central to all other perspectives. These activities only make economic sense when they follow logics of value creation and value capture e as such, a combination of activities may constitute a logic. Specific logics can be aggregated into business-model archetypes e therewith, archetypes constitute higher levels of aggregations than logics. Alternatively, activities can be enriched by adding elements of a business model in order to capture the result and impact of activities. The alignment of the elements, an aggregation of elements, can lead to business- model optimization.

All perspectives offer specific insights into business models and all of the perspectives are necessary for a complete un- derstanding of business models. Therefore, this is not a question of which perspective is correct or more important. The academic challenge is to define a conceptual language that allows for differentiation among the five perspectives in order to avoid confusion. The five perspectives described here may therefore serve as a starting point for consolidating the literature.

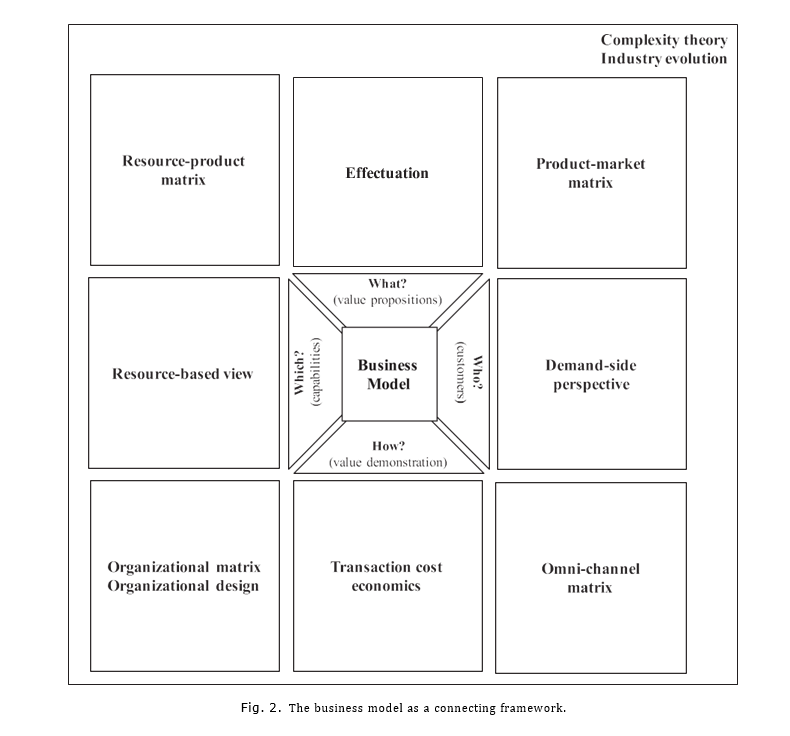

It is important for every research field to define its domain as well as its connections to other theories e to determine the areas that the theory covers. To this end, we position business-model research (with its five perspectives) within the strategic management literature (Fig. 2).

In our view, business models have the potential to enrich the strategic management discussion because they can link important streams of the literature, including the resource-based view (RBV), the demand-side perspective, and the dynamic capability view. This special issue provides interesting and thougth-provoking discussions about the conceptualization and understanding of business models as complementarity between activities and the role of business models as independent, dependent and moderating variable (Foss and Saebi) as well as the conceptual connections between business models and the demand-side perspective (Priem, Wenzel, & Koch), dynamic capabilities (Teece), entrepreneuship (Futterer, Schmidt, & Heidenreich), organizational design (Fjeldstad & Snow), complexity (Snihur & Tarzijan), and industry dynamics (Hacklin, Bjo€rkdahl, & Wallin). With this spectrum of theories, this special issue truly presents, and problematizes, the wider implications of business model research.

Resources are central for economic organizations (for overviews of the RBV, see, e.g., Barney, 2001; Barney et al., 2001; Wernerfelt, 1984). In the widest interpretation, “firm resources include all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness” (Barney, 1991, p. 101). Moreover, “these numerous possible firm resources can be conveniently classified into three categories: physical capital resources (Williamson, 1975), human capital resources (Becker, 1964), and organizational capital resources (Tomer, 1987)” (Barney, 1991, p. 206). In recent years, firms’ resources have been combined or reinterpreted as capabilities (for a discussion of the capability-based view of the firm, see, e.g., Sanchez, 1999). A capability is a qualification and/or skill necessary to perform a certain activity (Day, 1994; Drucker, 1985; Li and Calantone, 1998). Winter (2003, p. 991) defines an organizational capability as “a high-level routine (or collection of routines).” In this regard, organizational capabilities are encapsulated in firms’ processes and systems, which enable firms to repeat activities over time and, thus, to sustain capabilities. In other words, capabilities are organizational routines through which combinations of resources (inputs) are transformed into new resources (outputs). Certain elements of the processes and systems might be tacit and, therefore, hard for competitors to copy.

While there is a direct connection between business-model activities and business-model elements (typically, activities are one element), the importance of business-model research for the RBV lies in the opportunity to connect value creation and value capture with resources. A central question in the RBV is the value of a resource. Business-model logics can provide a structured method for assessing that value.

DaSilva and Trkman (2014) argue that business models connect a firm’s resource base with customer value creation, thereby linking the RBV with transaction cost economics. While transaction cost economics play an important role in our understanding of the boundaries of the firm and the ways a firm connects with its customers, the customer transaction itself is an essential element in business models. The best value proposition may fail if transactions with customers become too costly. In addition, transaction cost economics determine which activities a firm handles in-house, which activities are outsourced, and which activities are performed in partnerships. The central strategic decision of “make, buy, or cooperate” defines the optimal resource base as well as the design of the surrounding ecosystem. As Casadesus-Masanell and Ricart (2011, p. 102) suggest, “the success or failure of a company’s business model depends largely on how it interacts with models of other players in the industry.”

Particularly focusing on customers, researchers have called for better integration of the demand-side perspective in certain fields, such as technology management (Priem et al., 2012) and international business. Along these lines, Priem et al. (2012, p. 346) highlight the fact that “demand-side research looks downstream from the focal firm, towards product markets and consumers, to explain and predict those managerial decisions that increase value creation with a value system.” Demand- side research is closely related to the marketing field. The marketing concept is defined “as a philosophy of business management, based upon a company-wide acceptance of the need for customer orientation, profit orientation, and recognition of the important role of marketing in communicating the needs of the market to all major corporate departments” (McNamara, 1972, p. 51).

So far, we have considered static business models (e.g., DaSilva and Trkman, 2014; Casadesus-Masanell and Ricart, 2010), i.e. using the business model concept as a means to describe status quo, to take a snapshot of an organization. However, the different business-model streams are not only useful to describe a business model’s current state but also serve as frame- works for describing and developing its future states. The current and future states of a firm’s business model are connected by the firm’s dynamic capabilities e its abilities to reconfigure its assets. The idea of business-model innovation, which has also been referred to as “business-model modification” (Casadesus-Masanell and Ricart, 2011), “business-model reinvention” (Govindarajan and Trimble, 2011), and “business-model transformation,” (Aspara et al., 2013), has received a significant amount of attention. The inception of new business ideas, the development of existing business models, and the pioneering of new industries are central to this stream of research (Chesbrough, 2007; Markides and Sosa, 2013; Teece, 2010).

Business-model innovations occur “when the company modifies or improves at least one of the value dimensions” (Abdelkafi et al., 2013, p. 13). Alternatively, “business model innovation can be defined as “a process that deliberately changes the core elements of a firm and its business logic” (Bucherer et al., 2012, p. 184; see also Gambardella and McGrahan, 2010 and Foss & Saebi, this issue). Again, conceptual clarity of “business models in motion” is weak as there is no general definition to build upon. This important area evolves fragmented based on various insights from established fields e and with the potential for business model research to contribute to these fields and, thus, provide wider implications.

In Fig. 3, we have positioned prominent research streams along the business model to pinpoint the connections. There is a longstanding research interest in new product development including the development of services and offerings or in general terms new value propositions. Combined with efforts to learn about customers and markets, this sets the bases for growth strategies and diversification (Ansoff, 1957). Likewise, huge research efforts have been put towards understanding capability development (with a special interest in dynamic capabilities) and organizational learning. New capabilities enable optimization of the capability-value proposition matrix and the capability-value demonstration matrix e these efforts have been popularized in recent years as “lean” in practice. In the marketing area, social media has been one of the major changes in how organizations communicate with their customers e and these new value documentation channels have enabled changes in the onmichannel set-up.

In this introduction, we have argued for a combination of the five different perspectives of business-model research into one overarching business-model framework. By distinguishing among the perspectives and labeling them, we suggest a basis for consolidating the business-model literature. This may help us overcome some of the barriers to developing an overall approach to business models in strategic management. In order to advance business-model research, we need to develop a common language, generally accepted definitions, and a shared understanding of the concepts.

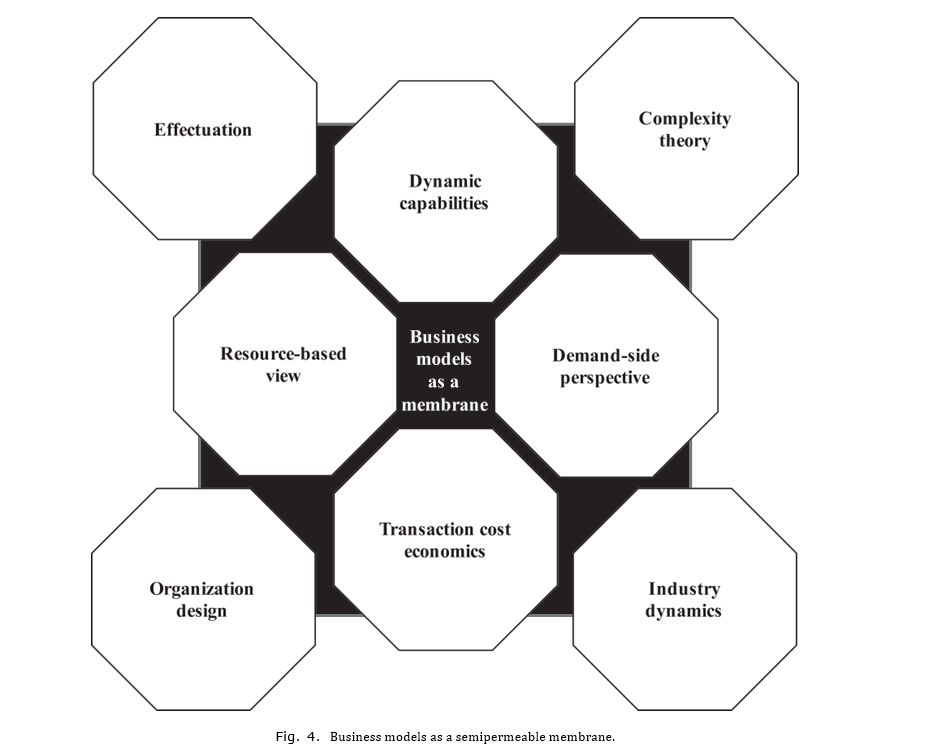

In addition, the discussion of how strategic management theories are connected with business-model research reveals that business-model research offers a necessary, highly valuable “connecting point” for several theories. While some discussions present conceptual arguments for or against the case of business models as a theory (or theoretical stream) in the strategic management literature, we perceive business models as the “webbing” between theories. Business models contribute to the academic discussion by enabling a connection between theories. As a metaphor, business models operate as a semipermeable membrane, “allowing passage of certain, especially small, molecules or ions but acting as a barrier to others.” (The Free Dictionary, 2017). In strategic management, business models allow for a connection between theories (e.g., RBV and demand-side) by allowing selected ideas from one theory to inspire other theories through a logical connection between the elements (e.g., the value of resources is modeled as demand).

This interpretation may ease some of the debate over whether the idea of business models is new or distinct. Instead of fighting for status as a theory in its own right, we suggest that the true contributions of business-model research to strategic management and, thereby, the wider implications of business-model research lie in its ability to explain and enable interconnections among theories. Theories are not like Lego bricks that click together effortless and perfectly they need glue to connect them. Business-model research may be much more central for the advancement of strategic management as this glue than as a theory. Research fighting for business-model research as a theory and, thereby, defining this stream of literature as distinctively different from other strategic management theories may prove unproductive. We argue that there is a distinct place for business models in the strategy literature as a “membrane” (Fig. 4) and that business models should contribute to theories rather than compete with them. Business models not only mediate “between technological inputs and economic value creation” (Chesbrough and Rosenbloom, 2002, p. 532) but also between theories.

Maadico is an international consulting company in Cologne, Germany. This company provides services in different areas for firms so they will be able to interact with each other. But specifically, raising the level of knowledge and technology in various companies and assisting their presence in European markets is an aim for which Maadico has developed … (Read more)